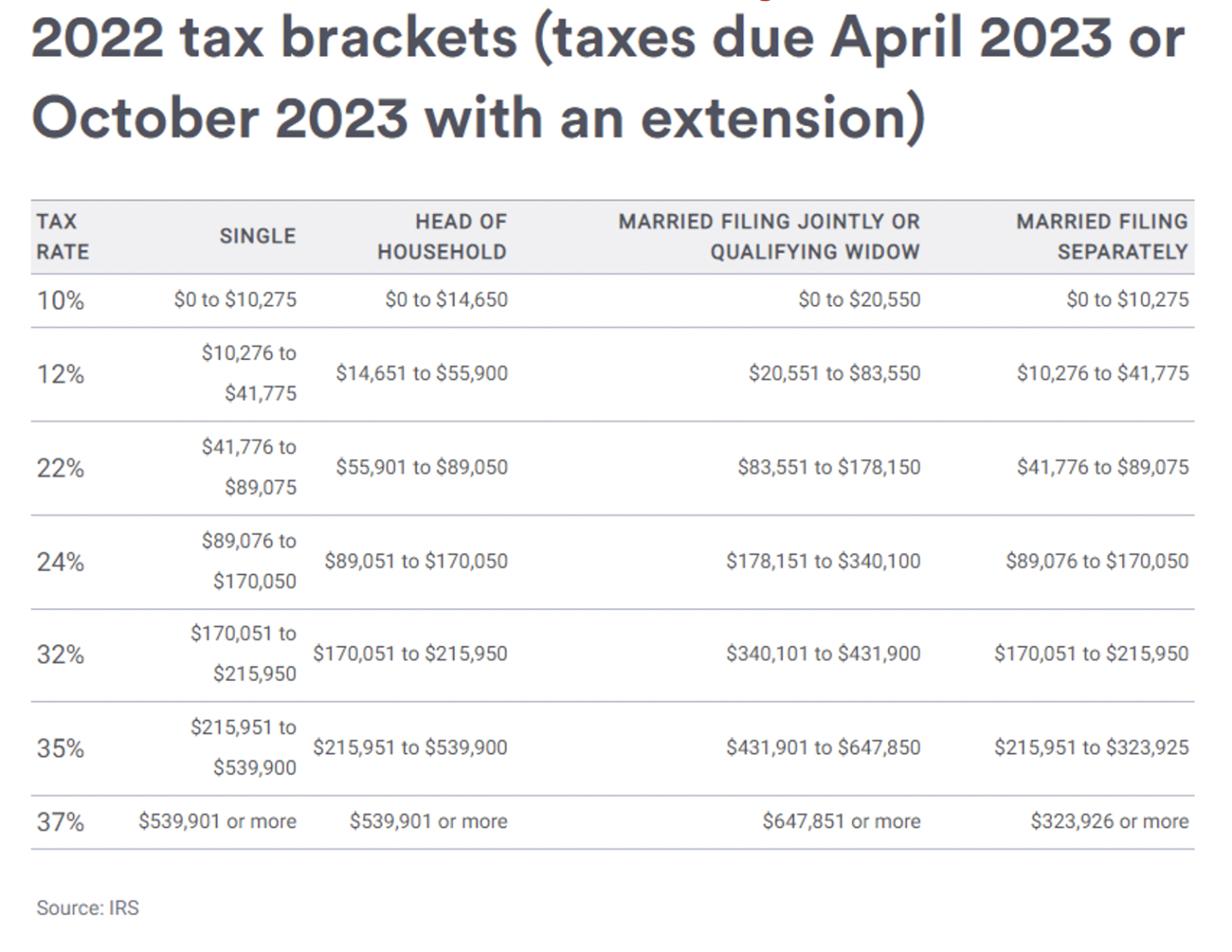

What Is Property Tax Deduction Limit The TCJA limits the amount of property taxes you can claim It placed a 10 000 cap on deductions for state local and property taxes collectively beginning in 2018 This ceiling applies to any income taxes

You can only deduct your property taxes if you itemize your deductions on Schedule A of Form 1040 This means that your total itemized deductions must exceed As an individual your deduction of state and local income general sales and property taxes is limited to a combined total deduction of 10 000 5 000 if married filing

What Is Property Tax Deduction Limit

What Is Property Tax Deduction Limit

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

Property Tax Definition Uses And How To Calculate TheStreet

https://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/acd49c56-5a02-11e9-a10a-7fe96a9d9db1.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

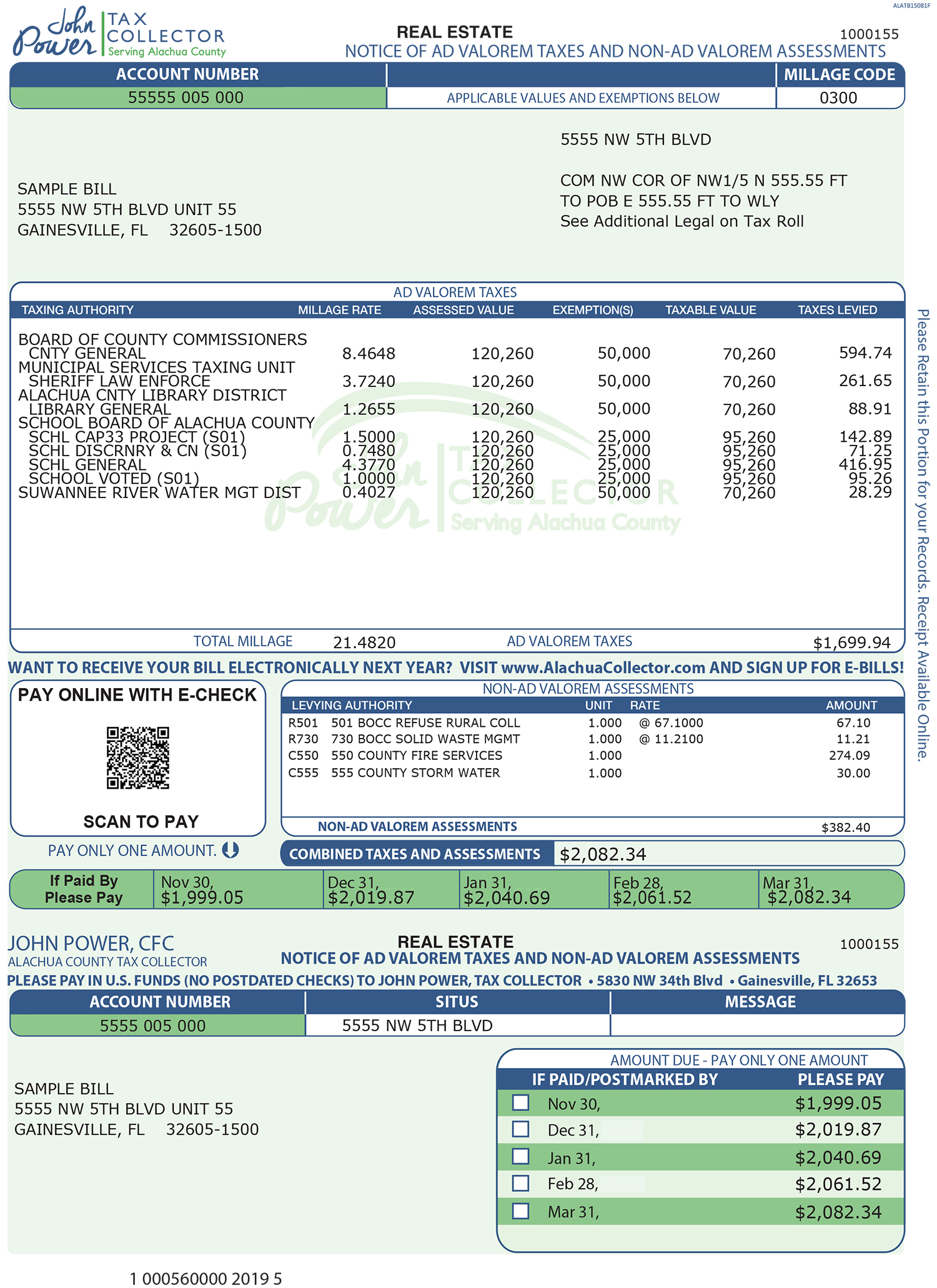

Income Limits on 2021 Property Tax Deductions The IRS limits standard property tax deductions for individuals to a maximum of 10 000 or 5 000 each for married couples Additional deductions may be available for 10 000 Annual Property Tax Deduction Limit Before 2018 you could deduct the full amount of property tax you paid on your home without any limit This enabled

You can t deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn t own the home until 2023 Instead you add the 1 375 to the cost The property tax deduction allows you as a homeowner to write off state and local taxes you paid on your property from your federal income taxes This includes your annual

Download What Is Property Tax Deduction Limit

More picture related to What Is Property Tax Deduction Limit

Property Tax 101 Real Estate Tax Cycle The Shoppers Weekly

http://theshoppersweekly.com/wp-content/uploads/2018/04/tax-1.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

Property Taxes Due This Week

https://kggfradio.com/assets/images/blogs/2019/property_taxes.jpg

In 2018 the IRS announced a new limit on property tax deductions allowing for of up to 10 000 5 000 if married filing separately to be deducted on a combination of property So it likely only makes sense to itemize and deduct your property tax if your total deductions exceed the 2022 standard deduction which is 25 900 for joint filers or surviving spouses 12 950

Historically property taxes paid on a home have been deductible without limit However for tax years 2018 through 2025 the TCJA places a 10 000 5 000 for The property tax deduction sometimes called the real estate tax deduction allows eligible homeowners to deduct their local property taxes from their federal income taxes See

How To Claim The Property Tax Deduction DaveRamsey

https://cdn.ramseysolutions.net/media/blog/taxes/government-and-taxes/property-tax-deduction.jpg

Deposit Your Due Property Tax Latest By 31st December 2019 Don T Ignore

https://www.alachuacollector.com/wp-content/uploads/2020/11/SampleBill.png

https://www.thebalancemoney.com/prop…

The TCJA limits the amount of property taxes you can claim It placed a 10 000 cap on deductions for state local and property taxes collectively beginning in 2018 This ceiling applies to any income taxes

https://www.noradarealestate.com/blog/property-tax...

You can only deduct your property taxes if you itemize your deductions on Schedule A of Form 1040 This means that your total itemized deductions must exceed

Tax Savings Deductions Under Chapter VI A Learn By Quicko

How To Claim The Property Tax Deduction DaveRamsey

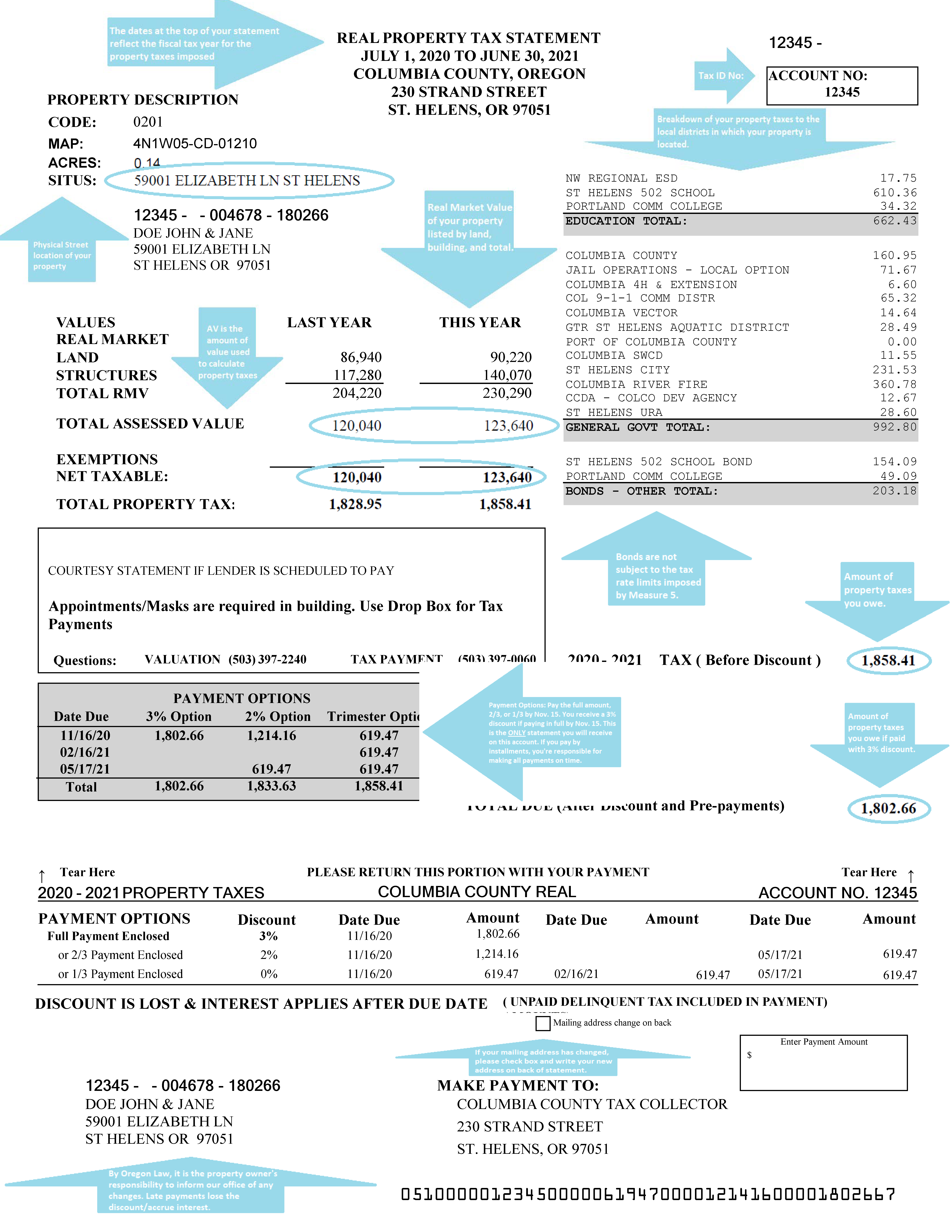

Columbia County Oregon Official Website Understanding Your Property

Section 80C Deductions List To Save Income Tax FinCalC Blog

How Does Tax Deduction Work In India Tax Walls

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Standard Deduction 2020 Self Employed Standard Deduction 2021

What Is A Tax Deduction

Income Tax Deductions For The FY 2019 20 ComparePolicy

What Is Property Tax Deduction Limit - 10 000 Annual Property Tax Deduction Limit Before 2018 you could deduct the full amount of property tax you paid on your home without any limit This enabled